Indian-Americans are Not a Drain on America

They Are a Dividend America’s Fiscal Strength, Not Burden

A New Look at Immigration and America’s Fiscal Future

For decades, U.S. political debates have painted immigrants as fiscal burdens—taking jobs, consuming welfare, and straining public finances. Yet new economic research has overturned that narrative with compelling data. According to a 2025 Manhattan Institute study by economist Daniel Di Martino, Indian immigrants and their descendants are not only self-sufficient but are also among the strongest contributors to America’s fiscal health.

For decades, U.S. political debates have painted immigrants as fiscal burdens—taking jobs, consuming welfare, and straining public finances. Yet new economic research has overturned that narrative with compelling data. According to a 2025 Manhattan Institute study by economist Daniel Di Martino, Indian immigrants and their descendants are not only self-sufficient but are also among the strongest contributors to America’s fiscal health.

In an era of mounting national debt—now surpassing $38 trillion—understanding which populations strengthen or strain the economy has never been more crucial. The numbers tell a striking story: Indian immigrants are America’s most fiscally beneficial immigrant group.

“Indian immigrants are not a drain on America — they are a dividend. Each engineer, doctor, teacher, and entrepreneur adds measurable value to the U.S. balance sheet and immeasurable vitality to its social fabric.”

The Numbers Behind the Narrative

The Manhattan Institute report, “The Fiscal Impact of Immigration: 2025 Update,” analyzes how different immigrant groups affect the U.S. economy and federal budget over a 30-year period. It calculates their impact on GDP growth, population, and—most importantly—the national debt.

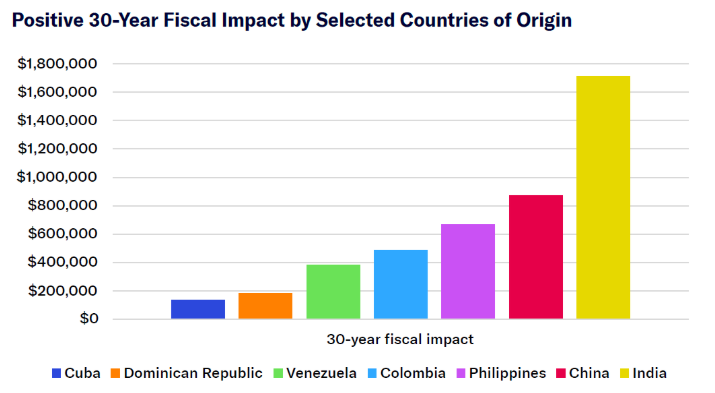

Among all major national-origin groups, Indians top the fiscal impact chart:

- Each Indian immigrant and their descendants save the U.S. federal government an average of $1.6–$1.7 million over 30 years.

- They also generate the largest per-person GDP increase among all immigrant groups.

- H-1B visa holders, many of whom are Indian, reduce the national debt by $2.3 million each and expand GDP by $500,000 over 30 years—the highest impact ever recorded for any visa type.

By comparison:

- Chinese immigrants reduce debt by around $800,000.

- Filipinos by $600,000.

- Colombians and Venezuelans by $500,000 and $400,000, respectively.

- At the other end, Salvadorans increase national debt by $50,000, and Mexicans by about $10,000 per person.

These findings directly challenge the widespread belief that immigrants add to America’s fiscal burden. Instead, they reveal a powerful truth: educated, skilled, working-age immigrants—especially Indians—help reduce America’s debt while growing its economy.

Why Indian Immigrants Excel

To understand why Indian immigrants deliver such an outsized fiscal return, it helps to look at who they are and how they integrate.

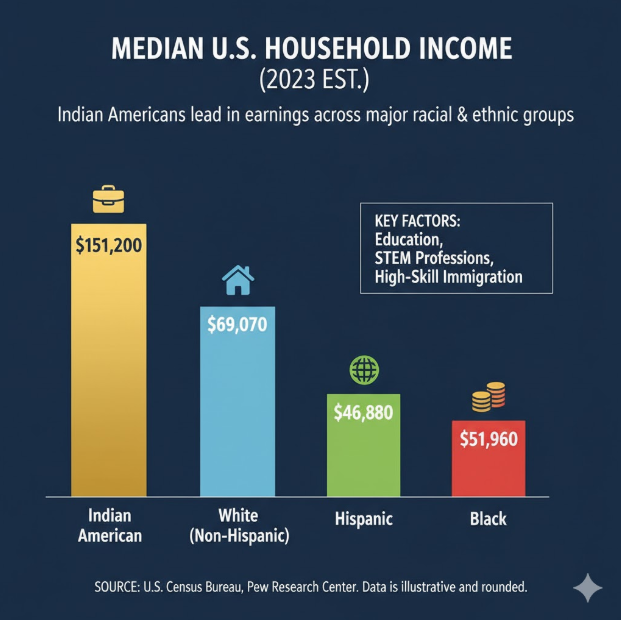

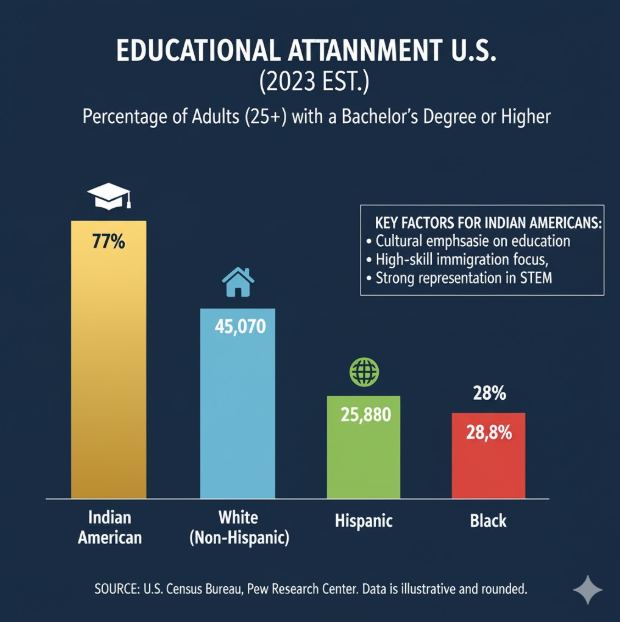

- Education and Skills

Indians are the most highly educated immigrant group in the United States. A majority hold bachelor’s or advanced degrees, and many have expertise in STEM, medicine, engineering, and finance. These professions carry higher salaries and generate substantial tax contributions. - Working-Age Entry

Most Indian immigrants arrive in their 20s and 30s—prime working years. This means they contribute taxes for decades before retiring and draw fewer age-related benefits during their initial decades in America. - Entrepreneurship and Innovation

Indian-origin entrepreneurs have founded or led many of America’s top technology and healthcare firms. From Silicon Valley startups to global corporations, Indian professionals create jobs, spur innovation, and expand GDP far beyond their population share. - Low Welfare Dependency

The community’s cultural emphasis on self-reliance, education, and family cohesion results in very low welfare participation rates. This reduces fiscal costs and enhances long-term economic integration. - Intergenerational Success

The children of Indian immigrants typically achieve even higher education and income levels than their parents. This multiplier effect ensures that the second and third generations continue to deliver strong fiscal dividends.

Collectively, these factors explain why the average Indian immigrant produces such a large surplus to the federal budget. As the report notes, fiscal strength correlates closely with education, skill level, and age at arrival—all areas where Indian immigrants excel.

“Fiscal impact shouldn’t be the sole criterion for immigration policy, but it is a crucial and quantifiable measure of long-term national interest.”

— Daniel Di Martino, Manhattan Institute

H-1B Visa Holders: America’s Hidden Asset

The report pays special attention to H-1B visa holders, who represent a large share of Indian immigrants. These skilled professionals—often in technology, medicine, and engineering—are America’s most fiscally positive subgroup.

According to Di Martino’s analysis:

- Each H-1B visa holder reduces the national debt by $2.3 million over 30 years.

- Each contributes roughly $500,000 to GDP growth in the same period.

No other visa class comes close to such impact. H-1B workers embody the “fiscal ideal” of immigration: skilled, productive, self-sufficient, and tax-positive. Yet paradoxically, this group often faces the toughest visa and green-card backlogs—particularly for Indian nationals, who can wait decades for permanent residency.

The report urges U.S. policymakers to double the number of high-skill visas while cutting total immigration by 10%. It also recommends granting more green cards to Indians and temporarily pausing visa quotas for other nations until the Indian backlog clears. Such measures, the author argues, would reduce the national debt by as much as $20 trillion over 30 years while maintaining economic competitiveness.

Illegal vs. Legal Immigration: A Fiscal Contrast

The research highlights the stark contrast between skilled legal immigration and illegal immigration.

- The average undocumented immigrant costs the federal government over $200,000 during their lifetime.

- Each new illegal entrant adds approximately $100,000 in additional costs.

- Deportations, though expensive in the short term ($12,000–$13,000 each), are estimated to pay for themselves within 30 years.

These numbers underline a simple fiscal truth: while high-skill immigrants reduce debt and drive growth, unauthorized immigration imposes long-term costs. The solution isn’t hostility toward immigrants, but smarter selection—one that rewards contribution, education, and legality.

“Each Indian immigrant and their descendants save the federal government an average of $1.7 million over 30 years — the strongest positive fiscal impact of any immigrant group in U.S. history.”

The National Debt Crisis: Why This Matters Now

America’s national debt now exceeds $38 trillion, rising faster than ever outside the pandemic years. Each trillion added compounds inflation, raises borrowing costs, and weakens the next generation’s purchasing power.

Economists like Kent Smetters of the University of Pennsylvania’s Wharton Budget Model warn that unchecked debt leads to:

- Higher interest rates on mortgages and auto loans.

- Reduced business investment and lower wages.

- Persistent inflation that erodes household savings.

In this environment, immigration isn’t just a social issue—it’s a fiscal one. Every policy decision about who enters the country affects long-term national solvency. As Di Martino emphasizes, “Fiscal impact shouldn’t be the sole criterion for immigration policy, but it is a crucial and quantifiable measure of long-term national interest.”

Policy Implications: Toward a Smarter Immigration System

The Manhattan Institute report calls for a pragmatic, merit-based system that prioritizes education, employment, and fiscal contribution. Its core recommendations include:

- Reduce total legal immigration by 10%, while

- Doubling high-skill immigration—particularly through H-1B and similar employment-based categories.

- Increase green-card quotas for Indian professionals and streamline the process to eliminate decades-long waiting times.

- Use fiscal impact as a measurable benchmark for future immigration reforms.

Such policies could align immigration with fiscal responsibility, ensuring that every newcomer strengthens the national balance sheet rather than burdening it. They would also recognize the proven value of Indian and other high-skill immigrant communities.

For Indian-American Community Leaders: A Call to Action

The study offers more than statistics—it provides a strategic opportunity for Indian-American leaders to advocate for fairer policies and better representation. Key steps include:

- Highlighting contributions: Share these findings in public forums, civic discussions, and media outlets to counter misinformation.

- Political engagement: Encourage voter registration and informed participation in elections, since both major parties influence immigration law.

- Supporting STEM education: Mentor youth, fund scholarships, and strengthen the educational pipeline that has made Indian-Americans leaders in technology, medicine, and entrepreneurship.

- Lobbying for reform: Mobilize community organizations to advocate for backlog relief and transparent H-1B and green-card processes.

- Building coalitions: Partner with other high-impact groups—Chinese, Filipino, and others—to form a united front for merit-based reform.

- Educating policymakers: Present factual, data-driven evidence of the community’s fiscal and social contributions to America.

Community advocacy based on evidence, not emotion, will help reshape how lawmakers and the public perceive skilled immigrants. Numbers have power—but they need voices to amplify them.

Changing the National Conversation

Changing the National Conversation

“When immigration is guided by skill, education, and contribution, it doesn’t weaken a nation — it strengthens it.

Indian immigrants prove that smart immigration is smart economics.”

The findings should also reshape how Americans think about immigration in moral and cultural terms. Indian-origin professionals—numbering just over 4 million in a nation of 330 million—represent less than 2% of the population but contribute far beyond that share to national innovation and prosperity.

They are:

- One of the highest-earning ethnic groups, with median household incomes exceeding $140,000.

- Leaders in education, with over 75% holding at least a bachelor’s degree.

- Significant job creators, founding or leading major companies across Silicon Valley, healthcare, and finance.

When viewed through both fiscal and social lenses, the community’s success story is not an exception—it’s a model for how immigration can work best.

Beyond Economics: The Human Dividend

Behind the numbers are stories of individuals and families who exemplify what America values—education, hard work, and civic responsibility. From Indian doctors on the pandemic frontlines to tech innovators driving the digital economy, these immigrants have shaped America’s modern landscape.

Their children, born or raised in the United States, continue this legacy: excelling in universities, leading research labs, and running startups that employ thousands. This is the human dividend—a generational return on investment that statistics alone can’t capture.

A Broader Reflection: Immigration as Leverage

A Broader Reflection: Immigration as Leverage

In a time of rising political polarization, the message from the Manhattan Institute’s data is refreshingly unifying. It shows that smart, skill-based immigration doesn’t weaken a nation—it strengthens it.

Indian immigrants exemplify how openness, when coupled with merit, can become an engine of prosperity. They reduce the debt, raise productivity, and expand opportunity. They remind Americans that the question is not whether immigration benefits the country, but what kind of immigration policy serves the national interest.

A Dividend That Keeps Paying

America’s fiscal health and global competitiveness depend not just on domestic policy but on who it chooses to welcome. The evidence is overwhelming: Indian immigrants are not a drain—they are a dividend.

Each engineer, doctor, teacher, and entrepreneur from this community adds measurable value to the U.S. balance sheet and immeasurable vitality to its social fabric.

In the words of economist Daniel Di Martino:

“Fiscal impact shouldn’t be the sole criterion for immigration policy, but it is a crucial and quantifiable measure of long-term national interest. A well-designed policy mix can simultaneously strengthen the federal balance sheet, boost economic growth, and ease assimilation.”

If America truly seeks to rebuild its economy, reduce its debt, and lead the world in innovation, then it must recognize what the data already prove: the path forward is paved by skilled, responsible, and visionary immigrants—and Indians stand at the forefront of that future.