| We are living in a reformed tax world now, since the passage of the Tax Cuts and Jobs Act (TCJA) in 2017. For most of us, the effects of this act will not be felt until we file our 2018 Tax Return, due on April 15, 2019, or October 15, 2019 (if extended). Several new tax laws were introduced, and some were modified or removed from the existing tax code. It is very important to understand the effects of this tax law and how you can use it to your advantage to pay off in the months and years ahead.

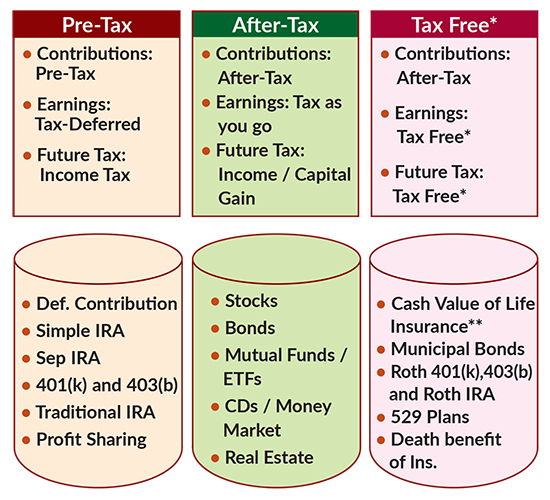

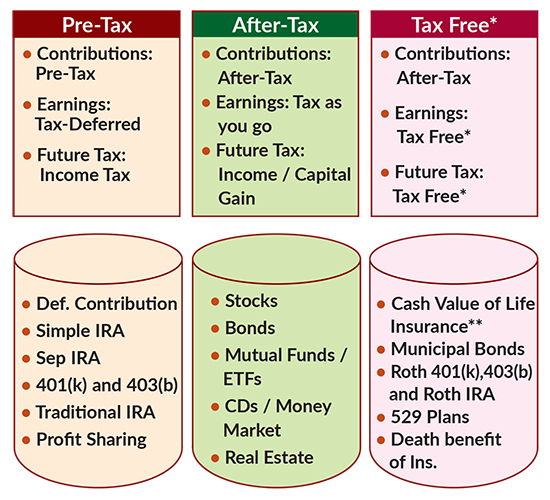

First, it is important to understand the three different tax structures. Every person should plan their taxes and finances around these for the most advantageous tax strategy and to keep more money to themselves rather than to pay off a hefty tax bill. First, it is important to understand the three different tax structures. Every person should plan their taxes and finances around these for the most advantageous tax strategy and to keep more money to themselves rather than to pay off a hefty tax bill.

Pre-Tax Structure

This structure allows you to invest monies pre-tax or before tax basis, giving you the tax deduction in the year of contribution. Earnings, dividends and interest grow tax free until you withdraw funds at a future date. Upon withdrawal, the income is taxable at the tax rate of your retirement, while the contributions are tax deductible at the rate in the year of contribution. Most of employer sponsored retirement plans such as 401(k) and 403(b) and also Traditional IRA, SEP IRA and Simple IRA are usually pre-tax. Although each plan has different contribution limit and plan rules, the tax structure is the same. The advantage of pre-tax structure is to save taxes in the year of contribution and get taxed in retirement when tax rates are usually lower. However, it is important to understand the various types of income you would receive in your retirement including social security and how this income would place you in a higher tax bracket in retirement, sometimes making your Social Security benefits taxable.

After-Tax Structure

This tax structure allows your after tax monies to be invested to earn more income in the form of interest, dividends or capital gains. Usually these are investments in Stocks, Bonds, Mutual Funds, ETFs, Money Market, CDs and Real Estate. Investment is considered as non-qualified and does not have any holding period such as pre-tax structure where you have to wait until you are 59 ½ years to withdraw your monies without any penalties. Tax is assessed in the form of regular ordinary tax for interest or capital gain taxes for stocks, bonds and real estate. There is no deduction for making this investment; however taxes are assessed in the year when the gains are realized by selling of those investments. Generally investment is done in this structure for shorter or medium term. This is also a person’s emergency fund when needed in times of need as they cannot tap in to pre-tax investments due to 10% additional penalties. There are no penalties associated to sell After-Tax investment at any point of time. The only thing to look out for is if the investment will be assessed short-term (lesser than a year) or long-term (one year o more) capital gain taxes. Long Term Capital gain taxes are generally lower than the short-term. |

Tax-Free Structure

This structure is probably the most underutilized and overlooked savings and investment option. Here you deposit after tax dollars and the assets grow income tax free and can possibly be withdrawn tax free as long as you follow rules associated with this asset class. This structure can provide dollar to dollar of the amount you may need. For example, if you need $50,000 every year on your withdrawal, then $50,000 from tax free structure translates to $50,000 of available monies, where as the Pre-tax bucket can possibly take out 20% of taxes or whatever your tax rate would be during retirement leaving you with only $40,000 (as 20% of $50,000 would go in paying taxes). Roth and Cash Value Life Insurance are some types of investment products that offer this benefit. Also 529 Plans do similar towards college education. To understand the benefit of this bucket, it is important to translate this in to real numbers.For example, if you are generate an 8% annual return, then a tax-free structure would double your monies in 9 years, where as if those investment returns are subject to 25% income tax than your monies will double in 12 years. This is the kind of impact taxes can have on your savings. Strategizing a tax efficient retirement is usually done by utilizing the correct mix from all three structures.Life Insurance can also be used as a Tax-Free Retirement Tool similar to Roth IRAs or Roth 401Ks. Remember that Roth and Loans from Cash Value Life Insurance Products are only two things that do not get included in your tax return when distributed upon Retirement and can be used as a Tax Free structure. Cash Value Life Insurance is a rich man’s Roth since the Roth has an Adjusted Gross Income limit of $203,000 in 2019, which means any married couple making over $203,000 and any Single Person making over $137,000 in 2019 cannot contribute to Roth, but they can consider investing in Cash Value Life Insurance Products.

|

| * This tax structure is potentially tax free and may lose its tax favored status under certain circumstances. Please consult your Tax Consultant or Financial Professional on how to take advantage of the items under this structure.

** Cash Value generally grow tax free and can be accessed via Loans and withdrawals up to the basis. Please consult your Financial Professional to ensure they do not convert in to a Modified Endowment Contract (MEC). The tax advantage status may be lost if the policy is surrendered and the gains and distributions may be accessed income tax and potential 10% penalty. |

Life Insurance as a Retirement Planning tool

We always think that life insurance is for the financial benefit for our relatives when we die, but we do not realize that we can often use it to our advantage sooner. We can structure our life insurance so that we can use it as an additional stream of income, especially during our retirement. Here is how a permanent insurance product can be used as an additional income source.

Cash Value with Whole Life

Whole life insurance covers you for a lifetime. They are generally more expensive than term life (which has a fixed duration of 10, 15, 20 or 30 years). In the whole life insurance policy you accumulate cash value, which also earns interest or dividends on tax deferred basis. You can borrow against the policy up to the amount of cash value you have accrued without paying taxes. If you receive dividends you will not owe any taxes on them unless you exceed the total amount of premiums you have paid. Based on how much you can borrow, you can use a whole life policy as a steady source of income in retirement. You do not have to repay loans against cash value. Outstanding loan balance reduces any death benefit payable to your beneficiaries when you die.

Universal Life an Investing Tool Universal Life an Investing Tool

Universal Life Insurance is another type of permanent coverage; however, it works little differently than whole life. You can still earn cash value based on the amount of interest earned as you pay your premiums. One key difference is that Universal Life gives you the flexibility of premium in which the premium amount can be adjusted based on your financial situation. You also can change your death benefit amount as needed. You can also use the accrued earnings in Universal Life to cover your premiums making this an attractive product for retirees. In addition to building cash value, there is also an investment component. A portion of your monthly contributions goes towards paying your premium costs and the remaining amount is invested in the investment vehicle of your choice. The investment performance determines your individual returns. You can borrow against the cash value tax-free. One has to be aware that the returns in universal life are not guaranteed. Work with your financial professional to select the best investment strategy for you.

Can I convert Permanent Policy to an Annuity to create a Lifetime Income stream?

If you have built up amount of cash value in a permanent policy then you may be able to convert that to an annuity, creating a regular source of income. An annuity is a product that you can purchase from a life insurance company. You typically fund an annuity with a lump sum and the insurer pays you a fixed amount for the duration of its lifetime. A lifetime annuity allows you to receive payments until you die. If you cash out a permanent life policy, you would have to pay tax on the earnings, however a 1035 exchange allows you to switch to an annuity tax-free. In an annuity you may not have a death benefit component similar as a life insurance product. If you have other assets for your heirs than you may want to consider this switch to pay for your retirement years.

Bottom Line

Developing a retirement strategy begins with knowing what your savings and investment options are. If you have not thought about Roth and Cash Value Life Insurance as tools to grow your assets tax free then you may be overlooking a potentially valuable source of income and savings. We can help you explore all of your options and determine which retirement strategy is right for you. We offer a free Financial Assessment for all our clients to help them make the right financial decisions for now and for retirement. |

|

About the Author About the Author

Umang Thakkar is a Sr. Partner with IncorpTaxAct LLC (www.incorptaxact.com). He is a Tax Expert with Planning Expertise and a Financial Advisor. For any tax or financial advice, please send an email to umang@incorptaxact.com.

Payal Agarwal is a Financial Professional Associate and a Registered Rep with Pruco Securities and Prudential. For any Life Insurance, Health Insurance, Annuities or Retirement Planning needs, please send an email to payal.agarwal@prudential.com

Views and opinions expressed are that of the author in this  article are not that of Prudential and Pruco Securities or any other Brokerage, Financial Services Provider or any other entity. Please consult your Tax Professional or Financial Advisor for any personal advice. No opinion expressed in this article should be considered as a professional tax or financial investment article are not that of Prudential and Pruco Securities or any other Brokerage, Financial Services Provider or any other entity. Please consult your Tax Professional or Financial Advisor for any personal advice. No opinion expressed in this article should be considered as a professional tax or financial investment

advice. |

First, it is important to understand the three different tax structures. Every person should plan their taxes and finances around these for the most advantageous tax strategy and to keep more money to themselves rather than to pay off a hefty tax bill.

First, it is important to understand the three different tax structures. Every person should plan their taxes and finances around these for the most advantageous tax strategy and to keep more money to themselves rather than to pay off a hefty tax bill.

Universal Life an Investing Tool

Universal Life an Investing Tool About the Author

About the Author article are not that of Prudential and Pruco Securities or any other Brokerage, Financial Services Provider or any other entity. Please consult your Tax Professional or Financial Advisor for any personal advice. No opinion expressed in this article should be considered as a professional tax or financial investment

article are not that of Prudential and Pruco Securities or any other Brokerage, Financial Services Provider or any other entity. Please consult your Tax Professional or Financial Advisor for any personal advice. No opinion expressed in this article should be considered as a professional tax or financial investment