|

Vince Lombardi, legendary coach of the NFL Green Bay Packers once said, “Plan your work and work your plan.”

It is very true that in order to accomplish anything in life, be it good grades in school, financial freedom, or a successful career, you must have a plan. But a recently published research report by Charles Schwab shows that three in five Americans live paycheck to paycheck and that only one in four has a written financial plan. Further, 45 percent of men and women who do not have written financial plan think they do not have enough money to start planning, while 20 percent say they never thought of having a financial plan, and another 20 percent say they wouldn’t know how to start planning.

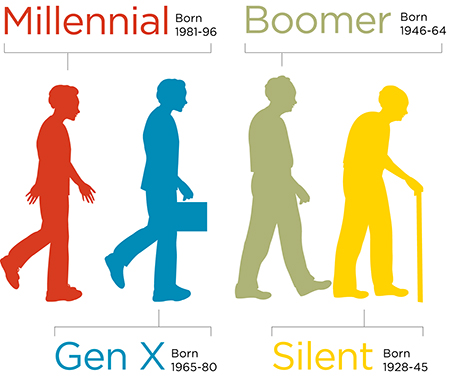

Millennial versus older generations

According to the same research report, millennials are in many cases more focused on saving, investing and financial planning than older generations: According to the same research report, millennials are in many cases more focused on saving, investing and financial planning than older generations:

- 31% percent have a written financial plan compared to 20% of Gen X and 22% of Boomers

- 36% have specific savings goals compared to 25% of Gen X and 17% of Boomers

- Nearly three-quarters regularly rebalance their investment portfolios compared to 66% of Gen X and 64% of Boomers

- Millennials are almost as likely as Boomers to work with a financial advisor (22% and 25%, respectively) while Gen X lags (16%)

- 64% of millennials believe they will become wealthy in their lifetime

Men versus Women

In another similar survey, Schwab found that young women are more driven to reach financial independence than young males (67% vs. 58%). They are more likely to take on extra work to make ends meet (28% vs. 23%) and see more value than men in creating a plan to achieve their financial goals (76% vs. 64%). Yet, despite all these good ‘first’ measures, they are investing and saving less than young men. In another similar survey, Schwab found that young women are more driven to reach financial independence than young males (67% vs. 58%). They are more likely to take on extra work to make ends meet (28% vs. 23%) and see more value than men in creating a plan to achieve their financial goals (76% vs. 64%). Yet, despite all these good ‘first’ measures, they are investing and saving less than young men.

Overall, women surveyed show greater awareness of day-to-day finances, budgeting and spending. More young women than men understand the value of making a financial plan, and higher percentages of women say they want to pay their own bills, remain debt-free and live independently. For example:

- More young women (76% vs. 64% of men) say putting together a financial plan is very important to reaching their financial goals;

- Almost half of these young women (49% vs. 39% of men) cite paying off student loans as a goal; and

- More women surveyed (41% vs. 32% of men) cited paying off credit card debt as a goal.

- Almost three quarters of women surveyed (73% vs. 56% of men) say they have chosen to hold off on buying something they wanted in order to save money.

- More than a third of women surveyed (36% vs. 27% of men) say they have skipped vacation or travel to save money.

While the women surveyed report spending 36% less than men, they have far less savings than men ($1,267 vs. $2,000) – a nearly 60% difference. In addition, twice as many young men as women say they would invest spare cash, and almost twice as many young men as women report having investment accounts (though most young adults do not invest at all). Finally, women surveyed were slightly more likely to carry a balance on a credit card, miss a bill payment and ask their parents for money to cover necessities. While the women surveyed report spending 36% less than men, they have far less savings than men ($1,267 vs. $2,000) – a nearly 60% difference. In addition, twice as many young men as women say they would invest spare cash, and almost twice as many young men as women report having investment accounts (though most young adults do not invest at all). Finally, women surveyed were slightly more likely to carry a balance on a credit card, miss a bill payment and ask their parents for money to cover necessities.

Benefits of Financial Plan

The research and the following table reveals that having a written financial plan can lead to better daily money behaviors.

|

|

Planners

|

Non-Planners

|

| Average Modern Wealth Index score |

68 |

44

|

|

Pay bills and still save each month

|

75%

|

33%

|

|

Have an emergency fund

|

65%

|

24%

|

|

Have life insurance

|

62%

|

39%

|

|

Feel financially stable

|

62%

|

32%

|

|

Never carry a credit card balance and make other loan payments on time,

or have no debt

|

42%

|

26%

|

|

Live paycheck to paycheck

|

38%

|

68%

|

When it comes to investing behavior, these planners are more likely to stay engaged with their investments, be aware of the fees they are paying, and have confidence about reaching their goals:

|

Planners*

|

Non-planners*

|

|

Consider risk tolerance when investing

|

82%

|

55%

|

|

Aware of fees and investment costs

|

78%

|

44%

|

|

Regularly rebalance portfolio

|

72%

|

31%

|

|

Feel ‘very confident’ about reaching financial goals

|

54%

|

17%

|

|

Measure progress against goals instead of performance

|

47%

|

41%

|

|

Have a diversified portfolio

|

22%

|

8%

|

|

*Among 2018 Modern Wealth Index participants who say they have an investment account

|

Parents Know Best

According to the report, below is some advice parents should start giving children at a young age:

- Parents should convey the same messages to boys and girls about money, but may need to tailor those conversations based on the individual and gender.

- While boys are spending more than girls, they also are saving more. Have open and honest conversations with your daughter(s) about the wage and savings gap.

- Teach kids about the importance of investing – especially girls, who as we see in this study, aren’t investing as much. Part of being financially prepared is learning to make the most of your money, and that means investing early and consistently.

- Encourage your children to take full advantage of a company retirement plan early and contribute at least up to the company match, more if possible. While retirement should be a top priority for everyone, it’s especially important for women, who tend to live longer than men.

|

According to the same research report, millennials are in many cases more focused on saving, investing and financial planning than older generations:

According to the same research report, millennials are in many cases more focused on saving, investing and financial planning than older generations: In another similar survey, Schwab found that young women are more driven to reach financial independence than young males (67% vs. 58%). They are more likely to take on extra work to make ends meet (28% vs. 23%) and see more value than men in creating a plan to achieve their financial goals (76% vs. 64%). Yet, despite all these good ‘first’ measures, they are investing and saving less than young men.

In another similar survey, Schwab found that young women are more driven to reach financial independence than young males (67% vs. 58%). They are more likely to take on extra work to make ends meet (28% vs. 23%) and see more value than men in creating a plan to achieve their financial goals (76% vs. 64%). Yet, despite all these good ‘first’ measures, they are investing and saving less than young men. While the women surveyed report spending 36% less than men, they have far less savings than men ($1,267 vs. $2,000) – a nearly 60% difference. In addition, twice as many young men as women say they would invest spare cash, and almost twice as many young men as women report having investment accounts (though most young adults do not invest at all). Finally, women surveyed were slightly more likely to carry a balance on a credit card, miss a bill payment and ask their parents for money to cover necessities.

While the women surveyed report spending 36% less than men, they have far less savings than men ($1,267 vs. $2,000) – a nearly 60% difference. In addition, twice as many young men as women say they would invest spare cash, and almost twice as many young men as women report having investment accounts (though most young adults do not invest at all). Finally, women surveyed were slightly more likely to carry a balance on a credit card, miss a bill payment and ask their parents for money to cover necessities.