The Seven Most Dangerous Enemies of Wealth

By Bimal Shah

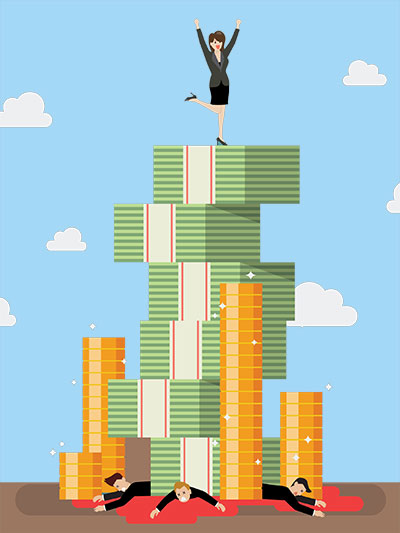

Hello, everyone. We have enemies everywhere. Today, we’re going to talk about the Seven Most Dangerous Enemies of Wealth. These are enemies that can take any, all, or some of your wealth much faster than you can imagine. I have included in this article simple steps that you can take today—steps which can help protect your wealth from these enemies.

Enemy #1: Lack of Planning and Discipline:

- The Lack of a Systematic Financial Decision-Making Process: Without proper planning and discipline, it is impossible to build wealth—whether slowly or otherwise. 94 percent of the time, failure to build wealth is the result of having had an improper system of money management.

- The first step is to have a budget. Then, we need to find out if there are any expenses that aren’t really necessary to maintain the lifestyle you live. If you have discovered some of those, bingo! You now have discovered Hidden Assets.

Purpose of Doing a Budget for the Wealthy: The purpose of the budget for the wealthy is not to find out where the money is going, but to allocate the spending of money where it brings happiness and meaning to your life.

- The next step is to maintain three types of primary personal bank accounts:

- Lifestyle Account: A bank checking account where we pay everyone else.

- Planning Account: This is a bank checking or savings account from where all your planning takes place.

- Wage Account (Emergency Account): You need to title your emergency account as a wage account, including wages of up to six months.

Planning for security against the enemies of wealth is a foundation to being wealthy (WEALTH + SecuritY = WEALTHY)

Planning for security against the enemies of wealth is a foundation to being wealthy (WEALTH + SecuritY = WEALTHY)

Enemy #2: Debt: Many misunderstand debt. Some might feel we should live debt free, while others believe that leveraging debt is good. You should understand two fundamental rules of thumb when it comes to debt:

Rule # 1: Debt-to-Liquidity Ratio: At a minimum, you should maintain a ratio of at least 10 percent liquidity to debt; and a 25 percent ratio is very good.

Rule # 2: Differentiating between Good Debt and Bad Debt: For any debt below 6 percent—whether it be a home loan, an equity line, or a property loan—there are tax advantages; and business loans or lines of credit that are not in the double digits fall in the category of good debt.

Enemy # 3: Taxes: It is absolutely imperative to pay the least necessary tax. In order to make sure you are paying the least necessary tax, you should be working with a team of people including a certified public accountant, an independent third party administrator, attorneys, independent insurance agents, benefit experts, and independent financial advisors.

Enemy # 3: Taxes: It is absolutely imperative to pay the least necessary tax. In order to make sure you are paying the least necessary tax, you should be working with a team of people including a certified public accountant, an independent third party administrator, attorneys, independent insurance agents, benefit experts, and independent financial advisors.

Enemy # 4: Unexpected Events: It is very important to be fully prepared for the unexpected, as unforeseen events could result in major changes in your life, family, business, or livelihood. Such events could include death, sickness, loss of job, or loss of business. The solution is having insurance that is right for you.

Enemy #5: Losses: The best way to make more money is to lose less money. Many chase high returns—as making a lot of money too soon has a lot of greed and excitement attached to it. However, it is very important to understand the system of market cycles. Also, someone shouldn’t put their foundational college educational fund assets and retirement assets at very high risk.

Enemy # 6: Lawsuits: It is absolutely imperative to protect your assets from lawsuits. Secondly, and at the same time, it is absolutely essential that you work with a good attorney who can provide you the best asset protection planning according to your needs and objectives. Thirdly, please make sure your assets are properly aligned to the plan you have structured.

Enemy # 6: Lawsuits: It is absolutely imperative to protect your assets from lawsuits. Secondly, and at the same time, it is absolutely essential that you work with a good attorney who can provide you the best asset protection planning according to your needs and objectives. Thirdly, please make sure your assets are properly aligned to the plan you have structured.

Enemy # 7: Unintended Heirs & Separation: It is very important to plan your legacy. If you do not, strangers and the government will inherit your money and assets. It is also possible to plan for a multi-generational legacy that could continue well beyond three generations.

Lastly, separation/divorce is an extremely sensitive issue. I would say divorce can be worse than death. Proactive investment in quality marriage counseling (both before and after marriage) is well worth any cost.

In conclusion, taking the simple steps outlined above can help protect your wealth from these seven most dangerous enemies of wealth.

About the Author

About the Author

Bimal Shah, as a financial advisor for 21 years, has helped the community to preserve and protect their assets, build lasting legacies, increase their income, and reduce the taxes they pay. To contact him, please email him at info@bizactioncoach.com or call him at 561-208-4032.